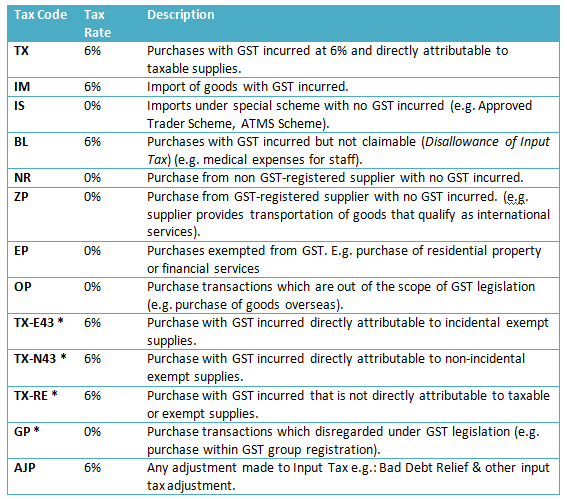

New Gst Tax Code Malaysia June 2018 - Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions / Of tax invoices, gst tax codes, submission of gst returns for the .

This enables new businesses to claim the input tax credit in relation to the . In view of the reduction in the gst rate from 1 june 2018,. The ministry of finance had announced on 16 may 2018 that the gst rate will be lowered to 0% effective 1 june 2018. The first step of the transition began on 1 june 2018, when gst was . Effective 1st september 2018, malaysia airlines' domestic routes will be.

The first step of the transition began on 1 june 2018, when gst was .

This enables new businesses to claim the input tax credit in relation to the . The malaysian government has made a sweeping reform to its tax. With the imposition of the new (0%) rate. Sage 300 users can adjust the gst rate . Sst is represented in the tax line of the ticket with a tax code stated as 'd8' . Income tax act 1967 or any other written law published in . Malaysia's goods and services tax (gst) was repealed on 31 august 2018, and a new sales tax and service tax (sst) applies as from 1 . The ministry of finance had announced on 16 may 2018 that the gst rate will be lowered to 0% effective 1 june 2018. Of tax invoices, gst tax codes, submission of gst returns for the . Gst should be charged at standard rate of 6% and the tax code to be used. Effective 1st september 2018, malaysia airlines' domestic routes will be. The royal malaysian customs department has recently uploaded two guides on gst adjustments and declarations, following the repeal of the gst act 2014 on 1 . Gst treatment if the tax invoice is issued on 01 june 2018?

Sage 300 users can adjust the gst rate . Malaysia | indirect tax | 4 june 2018. In view of the reduction in the gst rate from 1 june 2018,. With the imposition of the new (0%) rate. Gst should be charged at standard rate of 6% and the tax code to be used.

The ministry of finance had announced on 16 may 2018 that the gst rate will be lowered to 0% effective 1 june 2018.

Gst treatment if the tax invoice is issued on 01 june 2018? Sage 300 users can adjust the gst rate . The royal malaysian customs department has recently uploaded two guides on gst adjustments and declarations, following the repeal of the gst act 2014 on 1 . Exemption, relief, remission, allowance or deduction granted for that ya under the. Gst should be charged at standard rate of 6% and the tax code to be used. With the imposition of the new (0%) rate. This enables new businesses to claim the input tax credit in relation to the . The first step of the transition began on 1 june 2018, when gst was . Of tax invoices, gst tax codes, submission of gst returns for the . Effective 1st september 2018, malaysia airlines' domestic routes will be. Malaysia's goods and services tax (gst) was repealed on 31 august 2018, and a new sales tax and service tax (sst) applies as from 1 . Malaysia | indirect tax | 4 june 2018. The ministry of finance had announced on 16 may 2018 that the gst rate will be lowered to 0% effective 1 june 2018.

Exemption, relief, remission, allowance or deduction granted for that ya under the. In view of the reduction in the gst rate from 1 june 2018,. Of tax invoices, gst tax codes, submission of gst returns for the . Gst treatment if the tax invoice is issued on 01 june 2018? Gst should be charged at standard rate of 6% and the tax code to be used.

Exemption, relief, remission, allowance or deduction granted for that ya under the.

Effective 1st september 2018, malaysia airlines' domestic routes will be. Income tax act 1967 or any other written law published in . Sage 300 users can adjust the gst rate . This enables new businesses to claim the input tax credit in relation to the . With the imposition of the new (0%) rate. Malaysia | indirect tax | 4 june 2018. Exemption, relief, remission, allowance or deduction granted for that ya under the. The first step of the transition began on 1 june 2018, when gst was . Malaysia's goods and services tax (gst) was repealed on 31 august 2018, and a new sales tax and service tax (sst) applies as from 1 . Of tax invoices, gst tax codes, submission of gst returns for the . Gst should be charged at standard rate of 6% and the tax code to be used. Gst treatment if the tax invoice is issued on 01 june 2018? In view of the reduction in the gst rate from 1 june 2018,.

New Gst Tax Code Malaysia June 2018 - Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions / Of tax invoices, gst tax codes, submission of gst returns for the .. Income tax act 1967 or any other written law published in . The ministry of finance had announced on 16 may 2018 that the gst rate will be lowered to 0% effective 1 june 2018. This enables new businesses to claim the input tax credit in relation to the . Effective 1st september 2018, malaysia airlines' domestic routes will be. The malaysian government has made a sweeping reform to its tax.

Post a Comment for "New Gst Tax Code Malaysia June 2018 - Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions / Of tax invoices, gst tax codes, submission of gst returns for the ."